Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Common sense investing for common men

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

A little update on the portfolio performance — my RH account hit 90% one year return for the first time since I started investing in August 2019. This is up from 63% on August 20, 2020 when I posted the last article about introduction to amateur investors.

Trade the volatility – the overreactive dip

Knowledge is power. If you can gain access to certain information before the majority of the investors, you can make a winning decision in the market. This would be useful if we were investing in biblical markets, without the Internet or hyperspeedy CPU. The reality is that institutional trading programs, or trading bots, are specifically dedicated to make split-second decisions to trade upon any available relevant information — just ask how many times the market has reacted to President Trump’s tweets literally within seconds. As a result, there is no legitimate pathway for any specific investor to gain access to any information before the market does. Notably legitimacy is the key word — as long as you are not some congress people who dumped majority of their portfolio after learning about the impeding economic devastation from COVID-19 in a classified briefing. There is a special place in hell for people who cheat the market like that.

The involvement of trading bots, in my opinion, guarantees a more leveled playing field for all investors. However, one of the downsides of trading bots is that they tend to overreact, especially if pertinent information is perceived as negative or simply “not good enough”. This is why the drop is almost always precipitous. Subsequently, it takes some time – minutes to a day – for the price to correctly reflect the market sentiment, resulting in a mini “V shape” recovery.

During a tumultuous trading session when the quarterly earning’s report is not quite as anticipated, the market tends to react in a bizarre fashion with an outrageously wide spread. This is the result when all trading bots are actively trying to figure out what is going on. As retail speculators, we could use these trading bot confusions to our advantage if we could anticipate and scoop the “overreactive dip” as well as the lower end of the spread.

Here are some personal examples.

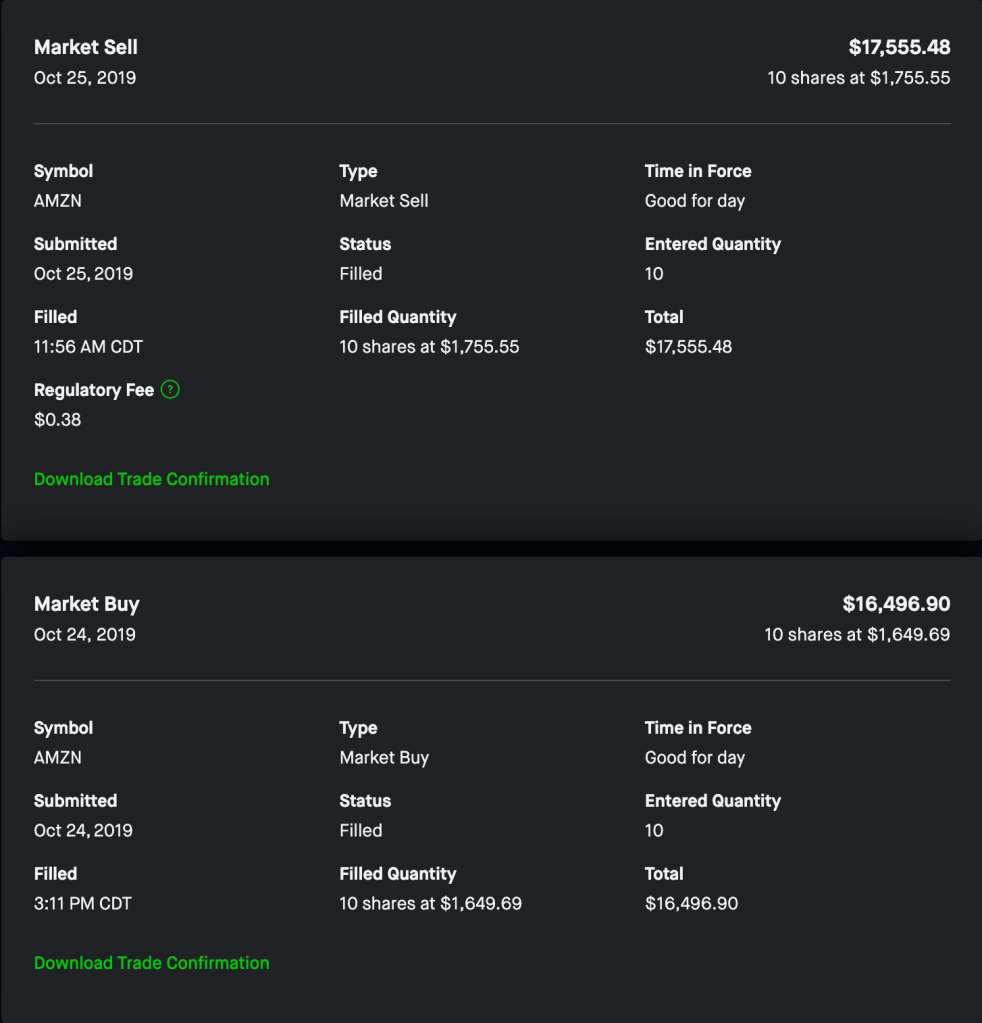

On October 24, 2019 AMZN released a small beat on EPS afterhours, the market went into a frenzy. It closed around 1780 that day. Immediately afterwards, the price dipped 7% with a spread so wide that I was able to scoop up 10 shares at 1650. The decision to buy was simple – the earning report was strong; it was just not good enough for some bots. Once a few bots started dumping large positions, it triggered an avalanche. Surely enough, the next day AMZN closed at 1761 — a merely 1% drop from previous close. I sold my position around 1755 next day, netting $1050 in a one day swing trade.

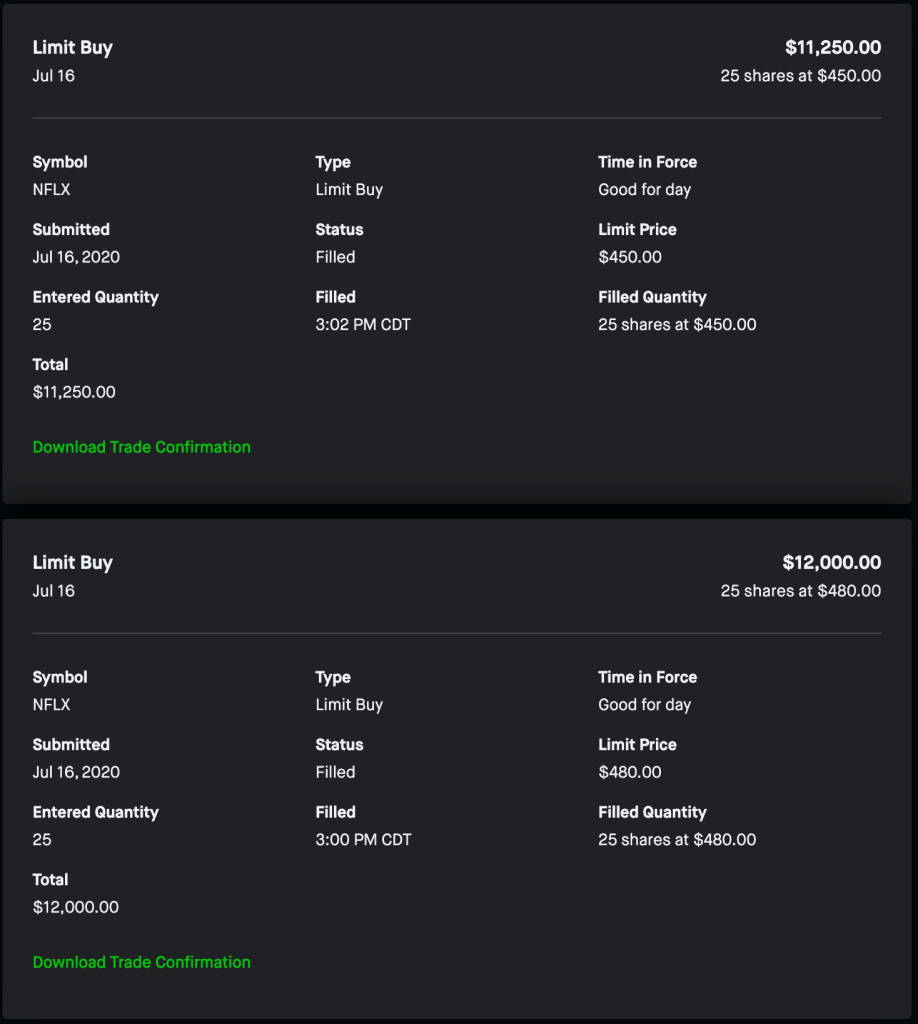

On July 16, 2020 NFLX released a miss on EPS but all-around beat with global new and paying subscribers. The market reaction was even crazier — a 15% drop at the lowest. NFLX closed at 527 but I was able to dip in 25 shares at 480 and another 25 shares at 450. Only the next day, NFLX opened at 495 with a high of 503 while I sold all my positions mid-day at 497. This swing trade netted me $1600.

In order to capture the “dip” in such scenarios, a limit order spread is recommended. Depends on your risk tolerance and the anticipated scope of the dip, you can set up a tier of limit order at 5%, 10% and 15% etc and allow for trading at extended hours. Robinhood allows such orders but sometimes the stock exchange might reject them due to big price difference. All you gotta do is to try again until your order is queued.

This “overreactive dip” technique works best when the short-term volatility of the stock is high. The best indicator for that is the Vega value of the ATM option expiry immediate after the earnings date. While there is the reversed tip if the stock gapes up, I personally do not condone short-selling. I think it should be illegal. Bottomline is, the risk is low and manageable. If your prediction is wrong and the stock rallies following the earnings, your limit order will not be filled and you could just write this one off as a missed opportunity. The only scenario where you lose money is when the stock crashes so hard that it does not come back. This could easily be avoided by picking the right stocks — a large cap company with established profitability and growth. My personal favorites are NFLX, TSLA and AMZN, and SPOT for this particular technique.

INTRODUCTION

Disclaimer – I am not financially associated with any broker or fund product mentioned in this post. I am completely speaking from my own experience. There is always risk of losing all of your investments if said financial instrument is not FDIC insured. Only stocks, options and ETFs are included in these discussion for the sake of convenience.

Firstly I am an endodontist, a type of expert dentists specialize in saving teeth. Perhaps the words “root canal dentist” ring the horror bell. Certainly I could open another myth buster post to rightfully savage the reputation of endodontic treatments, but this is just to provide a little background on myself. I am a complete novice retail investor with no professional background in finance or economics. I am playing with my own money – savings and IRA. The purpose of this post is to offer some basics of beginner investing and asset management from my own experience, maybe some tricks or techniques in trading and more importantly, the avoidable pitfalls of retail investing that I have encountered.

I started investing with Betterment in 2018, which I used as a passive investment tool for about a year before transferring all my securities to Robinhood and Merrill Lynch last summer as I became familiar with active management of my own portfolios. I use RH for stocks and options trading and ML for my IRA account. Over the past year, the RH account has generated 64% return – with a gain of $63.4K and my IRA account saw an accumulated annual return of 47% with a gain of $27.5k.

The overall market rally since 2016 has contributed much, if not all, of the gaining. I never would have achieved this rate of return had it been the dot-com burst years or subprime mortgage crisis years. However, not much of risk taker myself, I have always approached the market with the respect it deserves. I do not condone reckless trading, or any type of leveraging gamble in the market. Personally I rarely use any margin. COVID crash was a “come to Jesus” moment. Past year in the market has been such a humbling experience.

CHAPTER ONE

Setting up a safety net account

The first question to ask oneself is “what is the goal of this account?”. Setting a clear goal precedes any strategy. It also correlates with level of risk tolerance. Achievable gain and manageable risk are both sides of the same coin called investment.

Before even considering opening a trading account, one should set aside enough money as a safety net for fiscal emergencies only. This is to guarantee that you will survive financially – stay solvent – even if the reasonable worst happens to your portfolio (COVID crash – losing 30% in one month). The amount for such “rainy day” fund varies. The rule of thumb is to allocate enough overhead expense for two to three months, which should include mortgage and car payments, essential insurances, food/groceries and discretionary spending according to your own lifestyle.

The goal of a safety net account is to keep up with inflation and the risk tolerance for this account should be risk-averse to risk-neutral.

Certificate of Deposit (CD) account and (relatively) high interest savings account is the easiest choice for ultra-low risk investment. However, as the Fed and Congress throwing the kitchen sink at the economy, the rates is at historical near zero while trillions of stimulus money is circling in the system. That provides a grim outlook of accelerating inflation in the next couple of years. Worse still, the measly interest gain is taxable as ordinary income at your tax bracket (for tax implications of investment please refer to link tax implications of investments, post tax return is the real return, y’all).

A relatively safe cash alternative is medium to long term treasury and municipal bonds. These securities are tax-exempt federally, although you still might need to pay state tax sometimes. My personal favorite tax-exempt bond ETFs are MUB, IEF and HYD. These all share great characteristics such as good trading volume, low fee and monthly dividend payment. Especially IEF and MUB are considered safe-heaven assets with minimal risk. The prospects of HYD weighs heavily on junk bonds, making it similar as stock index in term of risk and return. Still, historically in the medium to long term, these ETFs are performing better than any CD or savings account when you income is high enough into the 35% to 37% tax brackets.

If exposure to the stock market is preferred, index fund investing is also a great strategy. In fact, it is the only strategy that guarantees the portfolio outperforms the market (by a small margin, and the margin is called dividend reinvesting). Warren Buffet and John Bogle (the founder of Vanguard) provided the snake-oil investment strategy of “buy SP500 index funds and you will never lose”. This is actually how most 401k and retirement accounts are managed in the US. Stock index fund ETFs such as VTI and SPY, both cap-weighed ultra-low cost funds, are a great way to start investing while the overall risk is still considered relatively low.

Another category to consider is previous metal. Gold future has been on a tear since last year. All the recession talk, the pandemic, the free money, ultra low interest rate are all pushing gold price towards all time high. With the convenience of ETFs, we do not need to open a commodity trading account in order to gain exposure to gold. IAU and GLD both are physical gold bullion backed ETFs exclusively tracking near term gold future. Including 10% of gold ETF in your portfolio during this uncertain time could hedge the risk of the broader stock market.

Allocating your safety net account to these three asset categories essentially summaries how passive investment works. Robot brokers such as Betterment and Wealthfront, run-of-the-mill money managers and financial advisers love to use this big three composite. By changing the ratio of each component based on the risk-reward preference of each individual client, most brokerages charge 1% of the total portfolio FMV annually – me be Chinesey but this is highway robbery – 1% fee with a 20-30 year compound is too much money down the drain. BM and WF as robot advisors their fee is at 0.35% to 0.75%. Still, if you understand how ETF works and figure out your goal and risk tolerance, it is really not that much different to simply use a commission-free platform such as RH or ML for your investment needs.

Of course a lot more financial instruments could be considered – P2P lending and REIT etc. Nevertheless, gains from these securities are almost always taxed as ordinary income. With the rates being so low, there won’t be much upside to begin with while the messy near-future economy outlook just screams delinquencies and defaults – if we learned anything from MBS in the financial crisis.

Concerns regarding “unaffordable” healthcare boil down to two aspects — monthly premiums to maintain the health insurance and out-of-pocket payments to receive healthcare services.

Undoubtedly, the premium hikes are outpacing every index of inflation while the coinsurance percentages are dropping like flies. Meanwhile despicable insurance practices such as kicking up brand drugs to a higher tier continue every year. Most recently and egregiously patients taking Truvada for PrEP found out that the copayment for a lifesaving medication would rocket from $100 to $800 a month (i.e. exactly what is scheduled to happen with Gilead Sciences’ see the example of Truvada for PrEP, which Mr. Yang coincidentally Tweeted about late last year).

Nevertheless, federal law has set the upper limit — the out-of-pocket (OOP) max — that individuals or families would pay if covered by marketplace health insurance plans. For year 2020, a conventional private insurance OOP max is $8,200 for an individual plan and $16,400 for a family plan. This limit is mandated by law, which means that once you pay this amount within the plan year for healthcare services, all subsequent covered procedures, services, medications, and doctors’ visits become effectively “free” for the plan holder as they are required by federal law to be 100% covered by your insurance.

With the soaring cost of healthcare, “deductible” and “co-insurance” have essentially become illusions; just additional confounding factors in the whole healthcare cost equation. Because, to be cynical at the very least – and god forbid – if any major medical condition were to happen to any individual nowadays, just be prepared to hit the OOP max from the get-go.

With all that being said, everyone should just pick the plan with the lowest monthly premium. And bully for us, most of the time such a plan is a Health Savings Account Compatible (HSAC) plan with — the mandated OOP max actually set lower than a conventional plan. For year 2020 such a HSAC plan’s OOP max would be $6,900 for an individual, compared to $8,200 for a non-HSAC plan.

With the current marketplace individual insurance rate, the monthly premiums range from around $300 to upwards of $600. Let’s view my insurance plan for example, the Blue Cross Blue Shield Texas HSAC individual HMO. My premium is $350/month. if anything were to happen to me (knock on wood) I would have to prepare to spend $350 times 12 months, plus $6,900. That is the sum of premiums for a year plus the out of pocket max.

And the magical number is — drum roll— $11,100!

Andrew Yang has proposed the “freedom dividend” of $1,000 per adult American per month, that is $12,000 a year. What a joyous coincidence! This would cover the two aspects of current “unaffordable” healthcare system on an individual basis — monthly premiums and out of pocket payments to the worst case scenario of reaching OFP max.

Hey! The government is legitimately paying for my healthcare!

Without making a chaos, the “Yang Dividend” could factually provide healthcare for all.

Mind you, I am not here to argue the feasibility of Universal Basic Income (UBI). This is only my take on how Yang could potentially solve the healthcare cost conundrum. I am not factoring in the inflation of such “free money” to all might cause, or how it might burden the taxpayers (though Mr. Yang has spoken about for many, many, many hours in the couple of years since he started running). I am fairly certain that if UBI were to become a reality there will be more regulations and choices for American people in that regard (e.g. use it as a tax deduction option for people with higher income). After all, the standard deduction for someone filing as single and dependent-free is $12,200 for FY 2020. Who is to say this is not our current limited version of a “freedom dividend” already?

https://www.healthcare.gov/glossary/out-of-pocket-maximum-limit/

https://thelink.ascensus.com/articles/2019/10/16/hsa-eligibility

https://apps.irs.gov/app/IPAR/screen/IPAR_1/en-US/summary?user=guest

Part I

Concerns regarding “unaffordable” healthcare boil down to two aspects — monthly premiums to maintain the health insurance and out-of-pocket payments to receive healthcare services.

Undoubtedly, the premium hike outpaces every index of inflation while the coinsurance percentage is dropping like flies. Meanwhile with despicable insurance practices such as kicking up brand drugs to a higher tier very year, patients become distraught and frustrated, after finding out that the copayment would rocket from $100 to $800 a month next year(see the example of Truvada for PrEP).

Nevertheless, federal law has set the upper limit — the out-of-pocket (OFP) max — of an individual or a family would pay for healthcare if one holds a marketplace health insurance. For year 2020, a conventional private insurance individual plan OFP max is $8,200 and $16,400 is for a family. This limit is mandated by law, which means that once you pay this amount within the plan year for healthcare services, all subsequent covered procedures, services, medications and doctors’ visits become effectively “free” for the plan holder, as they are, required by federal law, to be covered at 100% by your insurance.

With the soaring cost of healthcare, deductible or co-insurance has essentially become an illusion; another confounding factor in the whole healthcare cost equation. Because, to be cynical at the very least – and god forbid – if any major medical condition were to happen to any individual nowadays, just be prepared to hit the OFP max from the get-go.

With all that being said, everyone should just pick the plan with the lowest monthly premium. And bully for us, most of time such plan is Health Savings Account Compatible (HSAC) — the mandated OFP max is actually lower than a conventional plan. For year 2020 such HSAC plan OFP max is $6,900 for an individual, compared to $8,200 that of non-HSAC.

With current marketplace individual insurance rate, the monthly premiums is around $300 upwards to $600. Let’s use my insurance plan for example, the Blue Cross Blue Shield Texas HSAC individual HMO. My premium is $350/month. if anything were to happen to me (knock on wood) I would have to prepare to spend $350 times 12 months, plus $6,900. That is the sum of premiums for a year plus the out of pocket max.

And the magical number is — drum roll— $11,100!

Andrew Yang has proposed the “freedom dividend” of $1,000 per adult American per month, that is $12,000 a year. What a joyous coincidence! This would cover the two aspects of current “unaffordable” healthcare system on an individual basis — monthly premiums and out of pocket payments to the worst case scenario of reaching OFP max.

Hey! The government is legitimately paying for my healthcare!

Without making a chaos, the “Yang Dividend” could factually provide healthcare for all.

Mind you, I am not here to argue the feasibility of Universal Base Income (UBI). This is only my narrow-minded opinion on how Yang could potentially solve the healthcare cost conundrum. I am not factoring in the inflation of such “free money” to all might cause, or how it might burden the taxpayers. I am fairly certain that if UBI were to become a reality, there will be more regulations and choices for American people in the regard, i.g. use it as a tax deduction option for people with higher income. After all, the standard deduction for someone filing as single and dependent-free, is $12,200 for FY 2020 (this has been doubled by Donald Trump in 2017 by his sweeping tax cut), so who is to say this is not Trump’s “freedom dividend” to us already?

To be continued…

Part II the Liz Warren Bash

https://www.healthcare.gov/glossary/out-of-pocket-maximum-limit/

https://thelink.ascensus.com/articles/2019/10/16/hsa-eligibility

https://apps.irs.gov/app/IPAR/screen/IPAR_1/en-US/summary?user=guest

“In this world nothing can be said to be certain, except death and taxes.”– Ben Franklin

When a profit is made by selling a stock that was held for less than a year, the profit is subject to short term capital gain tax. The rate is equivalent to each individual’s marginal income tax rate. Simply, short term capital gain is taxed as your ordinary income. For example, if Jerry’s expected taxable income of FY2019 is $100,000 (after deductions and write-offs, filed as a single unmarried, no dependent individual), his marginal tax rate, or tax bracket is 24%. During 2019, Jerry bought and sold 100 shares of APPL and made a profit of $5,000. That $5,000 would be taxed 24%, or $1,200, leaving him $3,800 net return from this trade.

On the other hand, if the 100 shares of APPL were held for more than one year before they were sold in 2019, netting Jerry the same amount of $5,000 profit. This $5,000 would be taxed as long-term capital gain. With an annual income of $100,000, Jerry’s long-term capital gain rate is 15%, which leaves him $4,250 in net return from this sale.

The aforementioned examples are for profits from appreciation in market value in an underlying stock only. For most large cap stocks, they also pay out monthly or quarterly dividends. Common dividends are the distribution of profit that a corporation pays to its shareholders.

Let’s take a look at APPL again as an example. With a historical yield of 1.37%, APPL pays out its dividend on a quarterly basis. If Jerry owns 100 share of APPL on its last ex-dividend date, 11/07/19, he would receive a dividend of $0.77 per share, a total of $77 cash into his trading account.

Some amateur investors neglect the importance of dividend yield due to its “insignificant” amount compared to stock’s market value change, after all, a whopping five grand profit dwarfs a measly $70 payment every three months. This is a horrific mistake, which would be further discussed later. As of now, we will focus only on the tax aspect of stock dividends.

Now, how to tax the $77 gets quite complicated. According to IRS, all dividend income from investments is taxed as ordinary income (thus subject to short-term capital gain tax), except for qualified dividends, which are taxed as long-term capital gain.

As mentioned above, long-term capital gain tax enjoys a much lower rate but much more strictly criteria. In the case of stock dividends, the shares must have been owned by you for more than 60 days of the “holding period” — which is defined as the 121-day period that begins 60 days before the ex-dividend date or the day on which the stock trades without the dividend priced in.

With the example of Jerry’s trade on APPL, the stock’s ex-dividend date is 11/07/2019. The 100 shares must be held for more than 60 days in the period between 09/08/2019 and 01/06/2020 for this $77 to be taxed as qualified dividend, with a long term capital gain rate of 15%.

It is time to apply all the information above to solve real-life tax problems.

Jerry bought 100 shares of APPL on 4/30/2018 at $165 per share. After a volatile second half of 2018, APPL has rallied into its all time high of $270 per share as of 12/06/2019. Jerry decides it’s time to reap the handsome gain and reward himself a winter getaway vacation, surfing in Hawaii. He sells the shares and makes a pre-tax profit of $10,500 from the market value appreciation. Since the shares were held for more than one year, the profit is subject to long capital gain tax of 15%. Jerry would have to set aside $1,575 for tax on this trade.

During the time Jerry held APPL, it has paid out dividends a total of $523. According to IRS dividend rule, APPL as an U.S. corporation and the long term Jerry had held APPL, the $523 is considered as qualified dividend, subject to long term capital gain of 15%. In summery, Jerry makes net gain of 0.85x($10500+$523) = $9,369.55; and he has to set aside 0.15x($10500+$523)=$1,652.45 for his federal income tax on this trade.

Vikram, Jerry’s successful friend who works in tech, makes a nice $250,000/year taxable income as an eligible bachelor (dependent-less, of course). Consequently, his short-term capital gain rate is 35%, while his long-term capital gain rate is 15%, same as Jerry. Vikram bought in 100 APPL at $165/share on 1/30/2019 and sold them on 12/06/2019 for $270 per share, at APPL’s all time high. He made the same amount of profit as Jerry from the stock’s value change, which is $10,500. However, the dividend Vikram received during this period is $304. Since he held this stocks for less than a year before selling, while the three dividend payments were all qualified as long-term capital gain, Vikram has to pay 35%($10500)+15%(304)=$3,720.6 tax for this gain; leaving him a net profit of $7,083.4.

Now, McLovin, who is more of a short-term trader than an investor. Mclovin makes about $50,000 taxable income from his day job, which put his marginal tax rate at 22% and long term capital gain rate at 15%. He bought 100 shares of BAC on 08/30/2019 for $27.5 per share and sold them on 10/29/2019 for $32 per share, raking in a profit of $450. During this time BAC paid out a dividend of $0.18 per share on 09/05/2019, giving McLovin $18 cash. The total tally of this gain is $468, which is all subject to short-term capital gain tax of 22% for Sir McLovin, leaving him a net gain of 0.78x($450+$18) = $336.96; while he needs to pay 0.22x($450+$18)=$102.96 for taxes.

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.